Understanding the Cost of Insurance with Assurity Life Insurance Company

Understanding the Cost of Insurance with Assurity Life Insurance Company

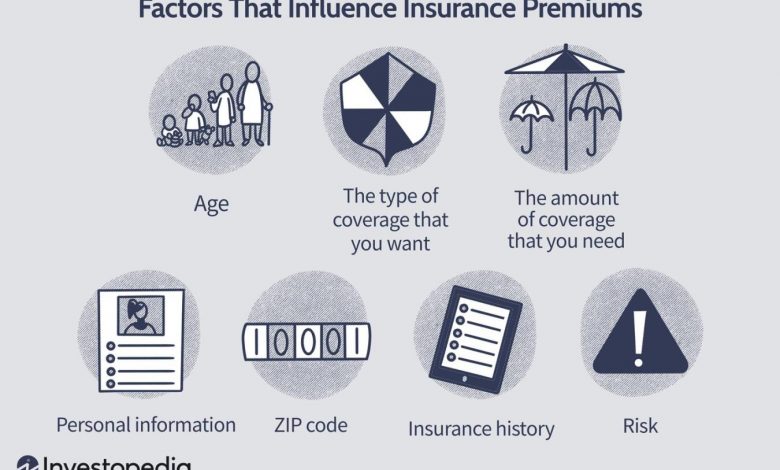

Factors that Determine Insurance Cost

1. Age and Health

When it comes to life insurance, age and health are major factors that determine the cost of coverage. Younger individuals who are healthier usually pose lower risk to insurance companies, resulting in more affordable premiums. On the other hand, older individuals or those with pre-existing health conditions may face higher premiums.

2. Coverage Amount

The amount of coverage you choose also plays a significant role in determining the cost of insurance. Generally, the higher the coverage amount, the higher the premiums will be. It’s important to strike a balance between having adequate coverage and affordability.

3. Type of Insurance

The type of insurance policy you choose can affect its cost. Term life insurance typically offers lower premiums as it provides coverage for a specific period. Permanent life insurance, such as whole life or universal life, usually has higher premiums but offers lifelong coverage and potential cash value accumulation.

4. Lifestyle and Occupation

Certain lifestyle factors, such as smoking, heavy drinking, or engaging in risky activities, can impact the cost of insurance coverage. Similarly, individuals in high-risk occupations, such as firefighters or pilots, may face higher premiums due to the increased exposure to potential dangers.

FAQs about Insurance Cost

1. Can I get an estimate of the insurance cost before applying?

Yes, it’s possible to get a rough estimate of the insurance cost before applying. Many insurance companies, including Assurity Life Insurance, provide online calculators that allow you to input your basic information to get an estimated premium range.

2. Will my insurance cost increase over time?

With term life insurance, the cost remains level throughout the specified term. However, with permanent life insurance, the cost may increase over time due to factors such as age or changes in health status. It’s best to review your policy periodically with your insurance provider to ensure it still meets your needs.

3. Can I lower my insurance cost?

Yes, there are several strategies to potentially lower your insurance cost. Maintaining a healthy lifestyle, quitting smoking, and participating in regular exercise can help reduce the premiums. Additionally, choosing a shorter term for term life insurance or opting for a smaller coverage amount can lower the cost.

4. Should I solely focus on finding the cheapest insurance option?

While affordability is important, it’s crucial to consider the coverage and financial strength of the insurance company as well. Look for a reputable insurer like Assurity Life Insurance Company that offers competitive rates along with excellent customer service and a strong track record.

In conclusion, understanding the factors that influence the cost of insurance can help you make informed decisions when choosing the right coverage for your needs. Keep in mind that costs vary based on individual circumstances and the type of policy. By considering these key factors and seeking guidance from a trusted insurance provider like Assurity Life Insurance Company, you can ensure that you make the best choice for your financial security.

Remember, it’s always a good idea to speak directly with an insurance professional to discuss your specific situation and get accurate quotes tailored to your needs.